The EPA’s Office of Inspector General found continued lack of enforcement of the EPA wood heater regulations, more than a year after its first major investigative report found similar issues. Unlike that in-depth report, this new report cites very specific details of instances where manufacturers and labs have violated EPA regulations. It found that even when the EPA knew of significant violations, it did not take action to correct the problem.

The wood heater manufacturing and test lab industry is a collegial community where members rarely publicly criticize other members, even when major violations of the EPA regulations are widely known. However, manufacturers often relay private complaints about their competitors to the EPA, putting the EPA on notice of a wealth of compliance issues.

“We call on EPA leadership to provide more resources toward the wood stove program and address systemic enforcement issues,” said John Ackerly, President of the Alliance for Green Heat. “Its also vital for the public to know that pellet stoves are not involved in much of this controversy and that many wood stove manufacturers make good products, follow the law and are being undercut by those who knowingly skirt regulations,” Mr. Ackerly said.

Over the last 15 years, the only entity that has consistently published specific instances of non-compliance is the Alliance for Green Heat (AGH) in its monthly newsletter, and on its website. Like the EPA, AGH is often contacted by industry members who are troubled by the conduct of other members. The OIG listed five instances of abuse that the EPA overlooked and failed to take sufficient action, but there are scores more. For instance, the internet continues to be rife with the sale of uncertified wood heaters, including outdoor wood boilers, which the EPA has known about for years, and appears not to have done anything.

US Stove sold 4,321 stoves before they were certified

This week’s report from the OIG follows up on several high-profile cases that AGH has pressed the EPA to address, including widespread fraud at US Stove Company which the EPA has been silent on for 5 years. In that case, an employee of US Stove was outraged and blew the whistle on his company. US Stove then sued the whistleblower, getting a Temporary Restraining Order (TRO) against him to shut him up, which the local Tennessee court said was “in the public interest.”

This week’s OIG report described how US Stove manufactured and sold 4,321 stoves before they were certified, and d859 of them were sold even before the test lab started testing the unit. Though the EPA had all of these details, it did lead to further action.

The stove in question was never officially recalled by the Consumer Product Safety Commission. A list of wood and pellet stove recalls can be found here.

A second whistleblower came forward, providing extensive details of fraud to the EPA, imploring them to take action. That person wrote: “To those of us who refused to cooperate with this fraud [at the US Stove Company], we had hoped that the EPA would step in, enforce its regulations, and thus provide some level of protection and dignity to whistleblowers. I expect US Stove may come after me, and possibly file a lawsuit against me, as they did with the first whistleblower. The company has dragged that man through the mud, and forced him to hire expensive lawyers, just because he was willing to stand up for EPA regulations.”

False advertising of efficiency

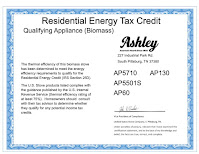

Another major issue that AGH has pursued over the years is false or misleading advertising of efficiency levels, often telling consumers that the unit is eligible for the IRS tax credit, which requires stoves to be 75% efficient, using the higher heating value (HHV). In one case, a test lab listed the stove at 70% efficient, but the manufacturer told consumers it was 75% efficient and eligible for the tax credit. The EPA sent the manufacturer a cease-and-desist request via email, which the manufacturer did not act upon. The OIG report said the EPA could have revoked the certification of the stove but has not taken further action.

False and misleading efficiency advertising was widespread up until 2021, when most manufacturers began to advertise the efficiency as reported by test lab, and listed in the EPA database of certified stoves. US Stove continued to falsely represent some of its units and declined to comment on the record. Stove Builder International, a large Canadian manufacturer insists that various interpretations of efficiency were acceptable until and unless the IRS defined “efficiency” more clearly. For example, some experts argue that if a stove reaches 75% efficiency on any official test burn, it can qualify even if the average efficiency of all four burns is less than 75%.

While the OIG vigorously raises the issue of false advertising of stove efficiencies, it is far from clear whether OECA even believes it has the authority to address efficiency. Efficiency testing became mandatory in 2020 but the EPA began listing efficiencies in 2012. The EPA does not regulate efficiency, as most European countries do, allowing stoves as low as 51% efficient to be certified.

EPA lab served as own third-party certifier

One of the 5 incidents of concern in the OIG report included an EPA approved lab serving as its own third-party certifier of a test report it has produced. Again, the EPA knew about this but did not revoke the certification and “the lab remained approved by the EPA.”

Test labs are allowed to be third party certifiers and most of them are. However, they cannot certify the results of stoves tested in their own lab. PFS-TECO, Intertek, OMNI, RISE (Sweden) and SZU (Czech Republic) are both test labs and third-party certifiers. PolyTest (Canada), ClearStak and the Danish Technological Institute are approved test labs but are not third-party certifiers.

Deviation from test methods

A fourth concern raised by the OIG, which has already been resolved, involved Lamppa manufacturing who makes Kuuma wood furnaces. Lamppa had obtained an alternative test method, but the test lab deviated from that method, due to complications. The manufactured disclosed the deviation and explained why, and the EPA certified it anyway. After 5 years, the EPA informed Lamp it would not recertify the unit, and Lamppa had to retest and recertify the unit.

Recommendation to the EPA

The OIG listed several significant recommendations, some of which could be incorporated into the next set of wood stove regulations, known as New Source Performance Standards (NSPS), which the EPA is currently working on.

· Including a federal criminal false statement clause into the wood heater certification application process, which would require manufacturers, but not necessarily retailers, to not make false statements in their advertising.

· Develop procedures to revoke the approval of test labs that do not follow NSPS requirements.

· Develop procedures to revoke the certification of wood heaters that do not coply with NSPS requirements.

· Inform the OIG of investigations into fraud or abuse of the wood heater NSPS.

The OIG report can be found here.