|

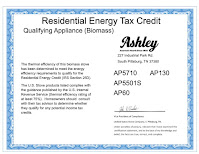

| A sampling of tax credit certificates issued by various manufacturers |

There was widespread exaggeration and misleading advertising about stove efficiencies in the preceding decade, and the EPA did not require wood and pellet stove manufacturers to disclose the efficiency of their models, or even to test for it until 2015.

Consumers are often advised to download the manufacturer certificate and keep it in their files, along with the receipt for the stove, as proof that they properly took the credit. However, the IRS does not require manufacturer certificates, and a screenshot of the EPA database, showing an efficiency of at least 75% for your model is even better documentation.

When Congress passed the new, higher tax credit legislation in 2020, they specified that the minimum 75% efficiency level must be measured using the higher heating value (HHV), eliminating previous ambiguity. However, Congress did not specifically refer to the EPA’s database, which lists the HHV efficiency of all stoves, boilers and furnaces. Almost all of industry accepts the EPA database should be used to confirm efficiencies and encourages consumers to check it. The Hearth, Patio & Barbecue Association (HPBA), the industry’s largest association, broke from its past practice and took a strong position that consumers should rely on the EPA database to determine efficiency.

|

| The Ashley line of stoves is owned by US Stove, which issued this current certificate. |

John Voorhees, Vice President for Compliance at US Stove, signed the tax credit certificate that states

|

| The Ashley certificate juxtaposed with the EPA database |

It is unclear why US Stove singled out the four models on this certificate when other models are listed with higher efficiencies, though none are above 75% except for one pellet stove made by their Breckwell brand. When the tax credit was first passed by Congress in 2009, most companies declared that all of their models qualified. That year, US Stove issued a certificate saying that 24 models were eligible for the credit requiring a minimum of 75% efficiency.

|

| In 2009, like many manufacturers, US Stove listed all or almost all of of their models as meeting the requirements of the 75% minimum efficiency tax credit. |

Today, most boiler and furnace companies also seem to be following Congress’s plain language and only certifying units at 75% or more. Boiler efficiencies are more complex because there are several test methods and the resulting efficiencies aren’t as comparable as they are with wood and pellet stoves. AGH found one indoor wood furnace manufacturer, Hy-C who makes the Shelter furnace, tested at 70% efficiency by the lab but the company issues a Certificate of Qualification that it meets the 75% HHV threshold.

Tax credits for consumer appliances have a variety of purposes, in addition to incentivizing consumers to buy higher efficiency appliances. They are designed to influence manufacturers to improve product efficiency, accelerate market penetration of more efficient products and potentially prepare the market for future mandatory requirements. Currently, there is no required minimum efficiency for wood and pellet heaters. For pellet stoves like the ones in question, they range from 58% efficient for a model produced by US Stove, to an 87% efficiency unit from Cleveland Iron works.

Wood and pellet stoves and boilers are an excellent way to reduce fossil fuels and affordably heat your home, especially in seasons like this one when fossil fuel prices are high. Federal tax credits are an efficient way to help households reduce fossil fuel use with a renewable, low carbon fuel. However, unless consumers use seasoned wood of under 20% moisture content, wood stoves can produce excessive smoke and will not reflect the efficiency achieved in the test lab. AGH considers pellet stoves to be the optimum choice, as their combination of high efficiencies and very low particulate matter make them suitable for both rural and more densely inhabited towns and suburban areas. Unlike wood stoves, the efficiency numbers achieved in the lab can generally be achieved by consumers if the unit is maintained properly.

Even though most manufacturers are now issuing tax credit certificates for stoves that are at least 75% efficient, AGH urges consumers to also check the EPA’s database of wood heaters to be sure. AGH has been in touch with IRS officials, urging them to issue guidance that wood heaters must be listed at 75% efficient or higher on the EPA database to close any remaining loopholes that a few manufacturers still try to use.

Further reading

AGH urges the IRS to recognize efficiencies in the EPA database, Feb. 2021

Guidance on the 26% tax credit for wood heaters, Jan. 2021

A review of wood and pellet stove efficiency ratings, Jan. 2014, updated May 2020

How to claim the tax credit, Feb. 2018, updated Jan. 2021

No comments:

Post a Comment