Thank you for this opportunity to provide comments. IRS guidance on wood heaters is long overdue. The Alliance is an independent non-profit organization that strives to represent the interests of consumers of wood and pellet heaters. We believe a tax credit for wood and pellet heaters is essential as we transition from fossil fuel to renewable fuels.

The IRS asked whether guidance needed to define the term "thermal efficiency rating"? If so, what testing procedures should the Treasury Department and the IRS consider requiring or permitting to be used by manufacturers to measure thermal efficiency and demonstrate ratings that are valid for purposes of the § 25C credit?

Summary: The most reliable method to protect consumers, ensure that tax credits are going to compliant models and create a level playing field for manufacturers is for Treasury/IRS to specify that eligibility is limited to units listed in the EPA Certified Wood Stove Database that have an overall weighted average efficiency of 75% or more using the higher heating value of the fuel.

Using the EPA database to determine eligibility is the most effective solution from a variety of public policy perspectives but it is not without problems: multiple test methods result in disparate EPA seasonal average efficiency results for wood and pellet boilers, which are not comparable, and which are not helpful for consumers or for the purposes of setting an efficiency threshold for the tax credit. The EPA is aware of the problem but an impending change in IRS guidance on wood heater tax credits is likely to hurt members of the industry who sell some of the most sophisticated modern wood heating equipment. We urge the IRS to consult with the EPA on this problem and find a solution as soon as possible.

In addition, we urge the IRS to make it clear that the $2,000 tax credit for wood heaters is in addition to the $1,200 for other 25C qualifying home projects, not instead of them. The IRS should clarify that the full $3,200 is available to taxpayers. We also urge the IRS to confirm that 25C tax credits are available to renters, not just to owners of residences, based on the removal of the term “owner” by Congress.

Finally, the IRS asked for comments on certification or other requirements for home energy auditors. We urge the IRS to affirm that when energy auditors are directed to inspect HVAC systems, that wood and pellet heaters are recognized as legitimate heating devices and need to be inspected for safety based on nationally recognized criteria, just as other heating systems are. Various agencies and institutions such as DOE, NREL and BPI have begun to address this problem but wood heater remain marginalized, leaving many older, self-installed units that pose fire hazards and are not being properly inspected.

Background on wood and pellet heater testing: There is universal acceptance among test labs and manufacturers that efficiency is measured using in accordance with CSA B415.1-10. When stoves are tested for EPA certification, the traditional test is to use the EPA’s “Method 28” which consists of 4 burn rates, from low (Category 1) to high (Category 4). The lowest burn rate allows the lowest amount of air to flow through the stove and typically produces a higher efficiency. High burn rates allow maximum airflow through the stove, and typically produce lower efficiencies. The labs then combine these 4 efficiency numbers and produce “a weighted average efficiency” which is what is recorded on the EPA database of certified heaters as “overall efficiency.”

CSA B415 produces three types of efficiency: Overall efficiency, combustion efficiency and thermal efficiency. The EPA uses Overall Efficiency to get an Average Overall Efficiency” and EPA guidance on testing deficiencies makes no reference to “thermal efficiency.” Even within the wood and pellet heater industry, there is confusion between the terms “overall efficiency,” “thermal efficiency” and “weighted average efficiency.” The image below is an representative example of how test labs report efficiencies.

Each of the four burn rates produces an overall efficiency number, and combustion efficiency number and heat transfer, or thermal efficiency number. The EPA averages the four overall heating efficiency numbers to get a weighted average efficiency. In the EPA database, this weighted average efficiency is in the column titled “Overall efficiency- HHV.” (The EPA used to use the term “Actual measured efficiency CSA B415.1 after they stopped using default, estimated efficiencies in 2015.)

There are eight labs approved by the EPA to conduct certification testing, including one in Canada, Czech Republic, Denmark and Sweden. The labs do not use efficiency terminology consistently, and often just refer to “efficiency” rather than “overall efficiency” or “weighted average efficiency” rather than “weighted average overall efficiency.” All labs clearly distinguish HHV and LHV, and no lab uses “thermal efficiency” in their weighted averages, as far as we know.

However, some manufacturers will use “Heat transfer efficiency” otherwise known as “thermal efficiency” numbers to qualify models for the tax credit because they tend to be 1-2% higher than “overall efficiency.” Thus, if a stove has an average overall efficiency of 75%, it could have a single burn rate as low as 69%, using thermal efficiency numbers. No manufacturer uses combustion efficiency for purposes of the tax credit as far as we know. Combustion efficiencies tend to be in the 96-98% range.

Wood heaters are tested by EPA approved labs and then the EPA uses the data in the report to certify the stove for sale. Once it’s certified the EPA puts summary data on its Database of certified wood heaters. Since 2015, the EPA has also required manufacturers to post the non-confidential parts of their lab test report on their website. Those reports are public and you can find the efficiency numbers for each burn rate, but they are not easy for consumers to navigate. On the contrary, they are dense, full of fine, highly technical jargon and are only used by regulators and experts.

Statistics: Currently, 25 of the 31 central wood heaters are eligible for the tax credit, using the EPA list. 113 of the 262 room heaters are above 75%, using the EPA list. Overall, that would make about half of all heaters eligible, if the IRS were to use the efficiencies listed on the EPA database.

Public policy considerations: To achieve a level of transparency for the consumer, using the EPA database of certified heaters is an obvious solution. Some consumers care about efficiency and the only place that consumers can make side-to-side comparisons is on the EPA database. With pellet stoves, efficiency typically matters more than wood stoves because unlike cordwood, all pellets must be purchased, and a more efficient stove can save consumers by using less fuel.

If the IRS wants to be more lenient with manufacturers and allow more than about half of heaters to qualify, it could keep allowing manufacturers to issue certificates without any guidance, or specifically say that if any burn rate achieves 75% efficiency or more, it can be eligible for the tax credit. If the IRS specified this, we expect all manufacturers would quickly adopt this system and about 80% or more of appliances would be deemed eligible.

Public policy is also served by setting a level playing field for all manufacturers, instead of allowing some brands to undercut others by claiming their units are eligible for the tax credit when they are below 75% on the EPA database. Almost all US manufactures now use the EPA database to determine if their models are eligible.

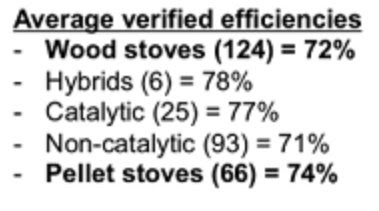

By setting an efficiency threshold for wood heaters, certain types of wood heater benefit. The Alliance for Green Heat has monitored the changes to efficiency in wood heater for more than 10 years and documented the various ways that manufacturers claim that their stoves are eligible for the tax credit. The averages below were calculated several years ago, when efficiencies were lower but the conclusion is remains the same: hybrid wood stoves have on average, the highest efficiencies are virtually all of them qualify for the tax credit, under any definition. More manufacturers are building hybrid stoves in order to qualify for the tax credit and whereas there were only 6 models several years ago, today there are at least 21. Non-catalytic stoves, the cheapest, most popular, and most basic stove, have the hardest time reaching 75% efficiency. Today, only 15 out of 113 non-catalytic models are 75% or over.

From a public policy perspective, setting a 75% efficiency minimum, using the EPA database of certified heaters, is positive in that it tends to favor stoves that emit fewer particulate matters (PM) emissions. Non-catalytic stoves tend to have higher emissions both in the lab and in the hands of homeowners if other factors are equalized such as moisture content of wood and ability of the operator. Pellet stoves and hybrid stoves tend to the cleanest, as used by homeowners.

Many taxpayers want to be able to download a certificate of eligibility to keep in their files, and taking a screen shot of the EPA list may not be as easy or feel as secure. The owner’s manual of the stove almost always has the weighted average efficiency, so that can also serve as proof of eligibility for the taxpayer.

There are two classes of heaters that would be unfairly penalized by an IRS requirement to base eligibility off the efficiency numbers in the EPA database. The first is that multiple test methods result in disparate EPA seasonal average efficiency results for some indoor wood and pellet boilers which are abnormally low and are not comparable to other boilers or helpful for consumers or for the purposes of setting an efficiency threshold for the tax credit. The EPA is aware of the problem, as is NESCAUM and NYSDERDA who are involved in testing programs to try to identify the calculations and assumptions leading to this problem and then find a solution.

The second are Masonry heaters are also penalized but since they do not yet have a pathway to EPA certification, the solution is more complicated. There are consistent and reliable ways to test factory-built masonry heaters and those manufacturers could issue Certificates of eligibility for the tax credit, but they will not be listed on the EPA database. Standard combustion chambers used in site-built masonry heaters could also be tested but this is more complicated. The Masonry Heater Association is the point group on this issue.

IRS options

The IRS has several options, depending on what their goals are.

1. The first, and best option, in our opinion is to use the “overall efficiency” numbers listed on the EPA database of certified wood heaters be the sole arbiter and end the practice of using manufacturer certificates, or only allow manufactures to issue certificates for heater models that are listed at 75% efficiency or higher on the EPA database. Many of the benefits of this are discussed above in the public policy discussion.

2. There is a hybrid option of allowing manufacturers to issue certificates of eligibility if a model exceeds is 75% efficient or over for stoves and outdoor boilers or furnaces, or is 75% or more overall efficiency on any of their burn rates for indoor boilers or furnaces.

3. There is the current system, where manufacturers self-issue a certificate to declare that a particular model is eligible, sometimes without any reference to efficiency figures or definitions. This has resulted in manufacturers claiming models with weighted average efficiencies as low as 64% to be eligible. This has also allowed manufacturers to claim units that are not EPA certified to be eligible without providing any efficiency data. Another weakness of this option is that there is no agency with the time, resources, or agility to provide enforcement in this area, leaving consumers vulnerable to false claims.

On the following pages, we have included representative samples of four types of manufacture certificates of eligibility for the tax credit. The disparity of the language used and the range of models that are claimed to be eligible for the credit show a clear need for more guidance for the IRS.

A. Example of a certificate that claims eligibility without reference to efficiency, even though it appears all units are above 75% efficiency based on the EPA database.

B. Example of a company that claims its units are eligible, even though they are well below 75% on the EPA list and do not meet 75% even on individual burn rates.

C. Example of EPA non-certified stoves without EPA approved third party lab efficiency data to claim eligibility.

D. Example of a certificate that claims models are eligible solely because they are “qualified energy property” with no reference to efficiency.

No comments:

Post a Comment